Reduce false declines with Risk Based Authentication in Protect Premium

We’ve enhanced Protect Premium with Risk Based Authentication, combining Protect and Authenticate to help you reduce false declines, recover legitimate shoppers, and stay protected through 3DS liability shift.

October 2025

Smarter fraud decisions with Risk Based Authentication

We’ve introduced Risk Based Authentication to Protect Premium. This new optimization uses Protect Premium’s machine learning fraud score to determine whether to block or authenticate a transaction. Instead of declining all payments above the selected risk threshold, lower-risk transactions are now sent to 3DS for authentication, allowing more genuine shoppers to complete their purchases.

How it works

By combining Protect and Authenticate, you’ll reduce false positives and boost successful transactions without increasing fraud exposure. Transactions that are authenticated benefit from a liability shift, meaning you won’t be liable for fraud on these payments. Note that NoFs resulting from this optimization count toward the VAMP and VFMP-3DS fraud programs, so merchant accounts above a 50bps VAMP ratio (as of August) are excluded.

Check your impact

You can track how this optimization affects your accounts directly in the Profile Analytics overview. Expect an FFCR increase of up to 1%, depending on your selected threshold and 3DS adoption in your region. For full details, visit the documentation on Docs.

Latest updates

- Adyen UpliftPersonalize

Smarter checkout, built on global intelligence

Deliver smarter, more profitable checkout experiences with Personalize, now live for businesses using our hosted checkout solutions.

Giving

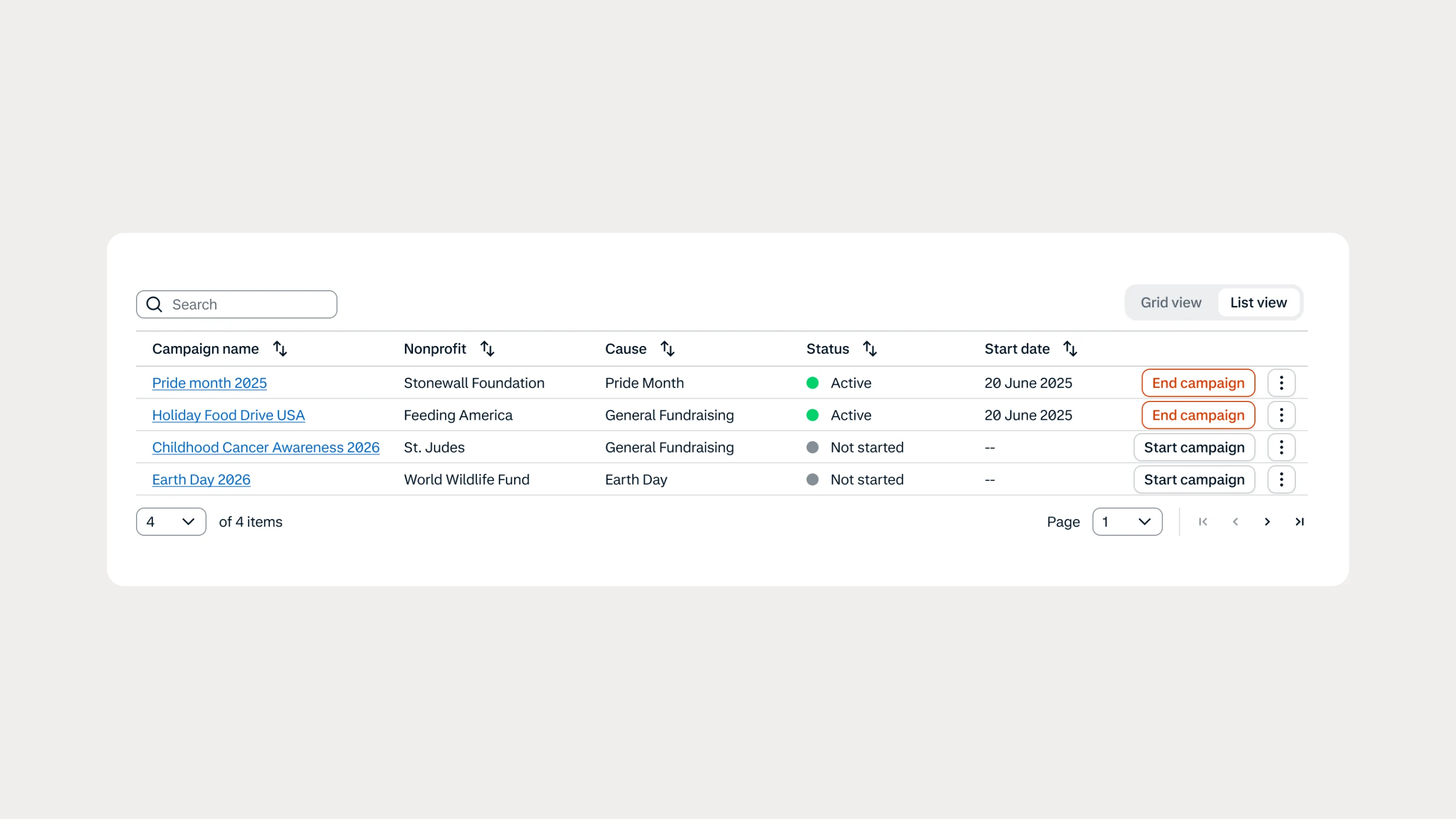

GivingManage Giving campaigns faster with new store and list views

Our new interfaces in Giving help you manage stores and campaigns at scale with better search, filtering, and visibility.