Guides and reports

All you need to know about digital wallets

As the popularity and usage of digital wallets continues to grow, we look at how they work and the most widely used wallets in the UK.

It wasn’t long ago that we were fumbling through our wallets and purses to get the right debit card out to pay. Either that or flipping through an array of loyalty cards to find the right one for the shop we were in.

But those days are in the past for many consumers and, thanks in part to the change of habits triggered by Covid-19, the rise of digital wallets has steadily gathered pace.

Digital wallets, also known as mobile wallets or ewallets, are an easier, lighter, and (thanks to their contactless nature) more hygienic way to make transactions. Outside of standard online card transactions, digital wallets dominate the ecommerce payment landscape. Our platform data found that in 2021, 25% of UK ecommerce payments were carried out via digital wallets and we can see that Apple Pay usage increased by 50% in December 2021, compared to the previous year. As such, they're currently the most popular alternative payment method in the UK today.

What’s a digital wallet, and how does it work?

A digital payments system is built for electronic transactions either using cards (likeVisa,Mastercard, andAmerican Express), user accounts, or pre-loaded funds. Instead of pulling out a card to re-enter details for every transaction, a digital wallet stores all necessary information needed to make a purchase.

Peer to peer payments are also available with some wallets, while others allow ATM withdrawals. All users need to do is confirm their identity, through the likes of a password, fingerprint, or facial recognition amongst other verifications.

How? Through secure software and tokenized credentials. Tokenization is a strategy that encrypts card data and connects to the issuing banks when a transaction is triggered to create a specific token to be used for the specific purchase. Whether your shopper is paying through a near field communication (NFC) connection in store or through other means on their computer at home, you as a business won’t receive any card info - just the token to complete the payment.

Digital wallets are used for more than transactions though; tickets, boarding passes, vouchers and loyalty cards are just some of the other documents that can be stored. No carrying around a stash of printouts and tickets before travelling, and no more hoping your worn-out high street coffee shop card will still collect points. This builds real brand affinity between you and your customers, as people use the wallets for all areas of life.

What’s behind the big boom?

One of main contributors to the growth of digital wallets is the acceptance and usage amongst the younger generation. Growing up in a more tech savvy world means this group is adopting them as a preferred form of payment, embracing the benefits as the norm. For example in the UK, 45% of Gen Z were making digital payments via mobile wallets in 2020, confirming that they‘re not just a trend.

45% of Gen Z paid with mobile wallets in 2020.

When we look at the benefits for you and your customers, it’s easy to see why they are being chosen more and more over physical cards. All offer a safe, smooth customer experience. Created specifically for commerce today, they are generally equipped with the latest security and authentication features. So it’s not only easier to pay, but safer too.

At Adyen, we are always ready with the latestpayment methodsto plug in and play for your business. No matter what type it is, our one-platform approach makes the entire process, from implementation to in-action, easier and quicker than if you were to launch a digital wallet alone. Benefits differ per wallet, but in every case, we focus on what we do best - payments - and give you more time to focus on your areas of expertise.

Let’s deep dive into the most popular wallets in the UK.

Top UK digital wallets

Apple Pay

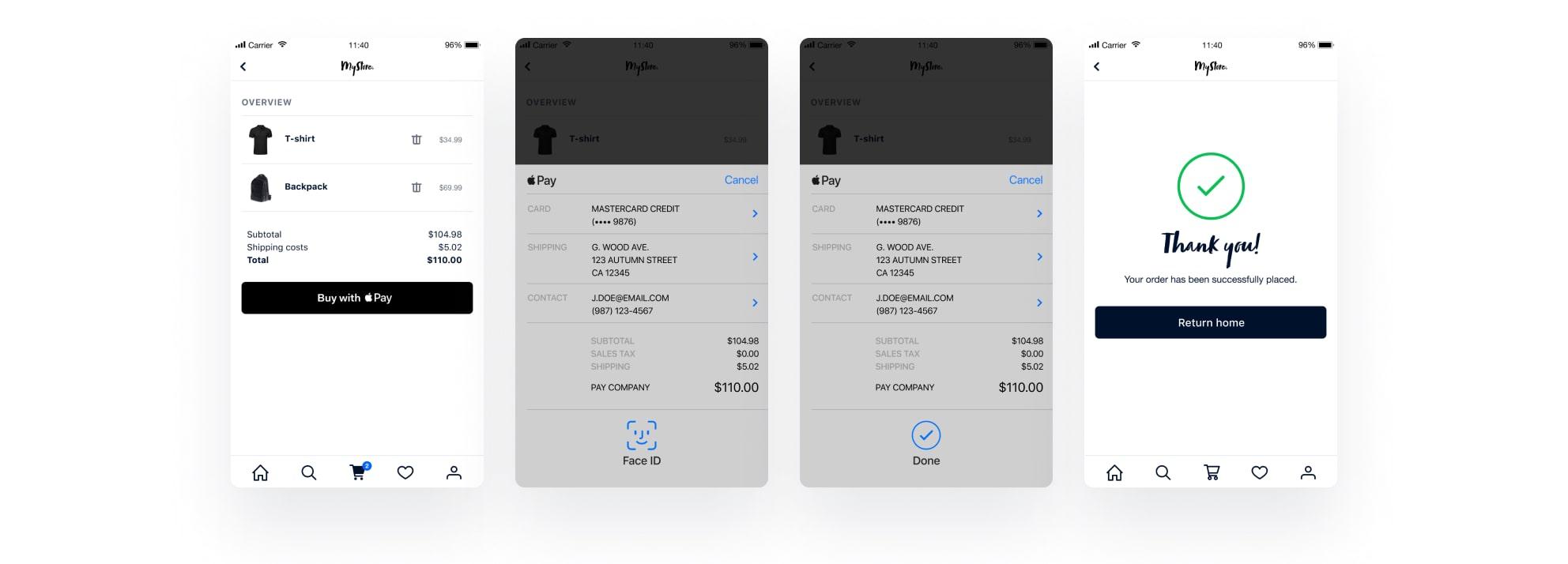

Apple launched its own wallet back in 2014, available on iPhones, Apple Watches Macs, and iPads. Usable in person via NFS terminals, through iOS apps and on Safari,Apple Paytruly taps all areas of iOS users’ lives by giving them an effortless way to pay built into their devices. And it’s a payment method oozing style, with Apple’s distinct UX lending itself perfectly to the overall process.

Apple Pay is great for retailers and businesses relying on high frequency orders, such as food delivery companies and coffee shops. Having it available via app or website immediately boosts conversion rates. This could be due to the fact that shoppers don’t need to leave the page to pay - a real perk for them and yourself. Plus authorisation rates are high thanks to strong authentication and secure storage.

Google Pay™

Google Pay™, G Pay to its friends, came about in 2018 after the clever unification of Google Wallet and Android Pay. Like its iOS counterpart, the wallet can be used in stores, via Android apps or online in the Chrome browser, using card details saved to a Google account. Thanks to Google’s strong security and identity control, Google Pay™ transactions are less likely to be rejected than regular card transactions.

One standout feature about this wallet is its ability to send location-based notifications. Say a customer is near your store and they have a voucher or gift card for you stored in their wallet, Google Pay™ will remind them of this. So what could have become an expired opportunity for money off becomes a valuable transaction.

PayPal

PayPalis a trusted financial service with over 400 million active users across 200 countries. It’s currently an online purchase tool only, therefore cannot be used at POS directly, but providing a QR code in store lets you connect physical and digital in just a few steps. PayPal is designed for conversion and optimised for mobile, while its built-in fraud detection and monitoring, including chargeback and seller and buyer protection capabilities, keeps things secure.

PayPal currently has over 400 million active users across 200 countries.

On top of the fast and reliable user experience, customers can opt for the Pay Later option with no additional cost to your business. With this feature, plus accepting 100 different currencies, it’s no surprise that shoppers are three times more likely to complete a purchase when PayPal is available at checkout.

Amazon Pay

As one of the most popular ecommerce platforms in the world, it came as a natural progression when Amazon launched its own wallet –Amazon Pay– in 2007. An easy integration into an ecommerce store, it gives a company’s customer base the ability to pay thanks to information already stored in their Amazon account on external merchant websites, via web and mobile.

That said, Amazon Pay is a great choice for the likes ofplatforms and marketplaces, hospitality, retail, and the food and beverage business. With the card and delivery details stored and ready, it means a friction-free payment experience for both yourself and customers. In the case of a card being rejected, there’s no waving goodbye to the transaction; users are given the chance to quickly and easily amend their details on the spot.

Attract Chinese shoppers

You also need to keep non-British consumers - residing in the UK, visiting or shopping online - in mind when it comes to offering an equally appealing buying process. Luckily, there are some key players in the wallet world that stand out from the crowd, and are definitely worth integrating.

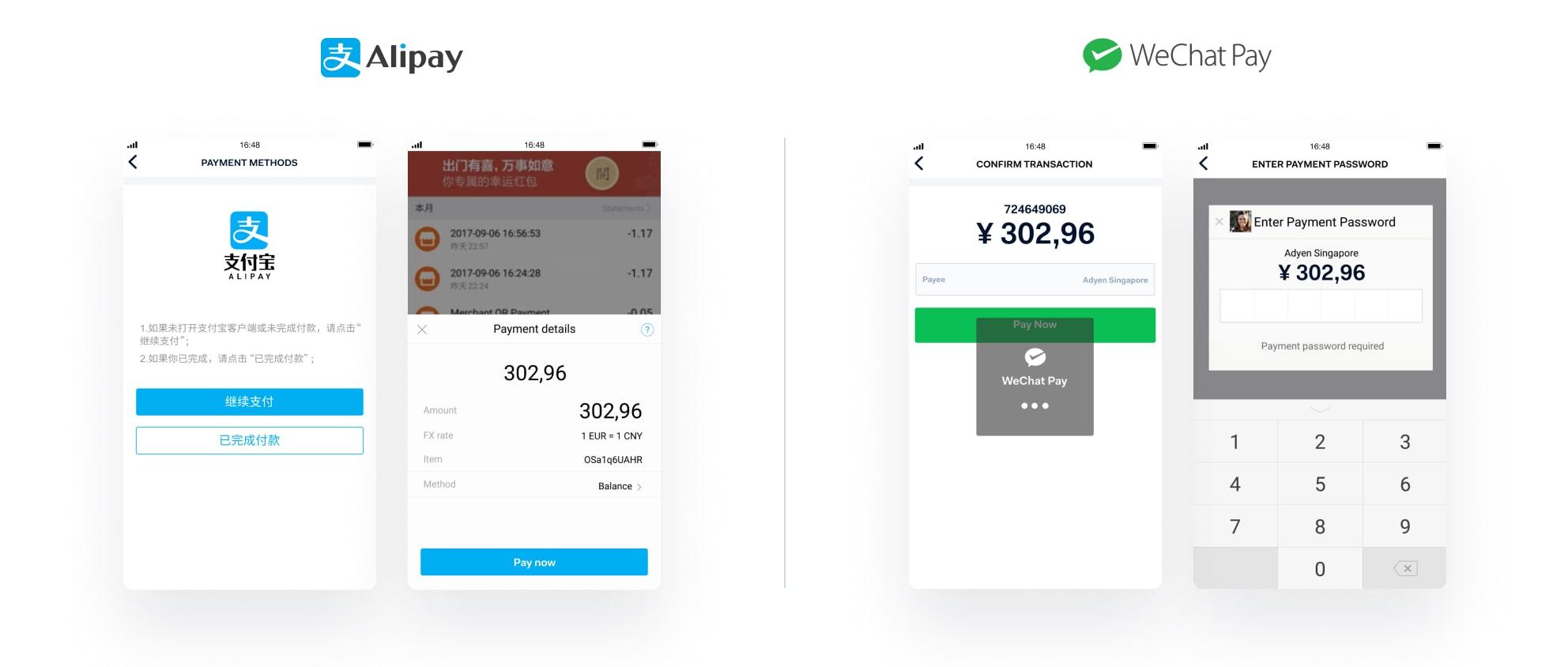

Alipay

Alipay is the most widely used third-party online payments service provider in China. Available to individuals only, users simply store their debit or credit card details in the app to be used online or in store via their mobiles.

There are different ways to pay using Alipay. Via Adyen we provide a dynamic QR code that already contains all the information like pricing for the shoppers to scan, or they provide their own for a cashier in store. Keeping that in mind, it’s a good fit for B2C businesses and it has over 800 million active users globally - not bad if you’re wanting to attract a bigger audience.

WeChat Pay

WeChat Pay is a digital wallet, born out of the eponymous Chinese superapp and currently boasting over 1 billion monthly users with Chinese bank accounts. Now an ecosystem built for chatting, browsing items and paying – all in one place – WeChat Pay can be used in-person as well as from desktop-to-mobile by scanning a QR code.

What was once a messenger service has now become a vital payment method for businesses looking to cater to Chinese shoppers, both home and abroad. In the UK, it’s a great choice for luxury brands, restaurant chains, and any other businesses that attract visitors from the Chinese market. It supports 25 different currencies, making it ideal for expansion too.

You can accept any wallet with Adyen. We’re always ready with the latest payment method to plug in and play for your business. Our one-platform approach makes the entire process, from implementation to action, easier and quicker than if you were to launch a digital wallet alone. Benefits differ per wallet, but in every case, we focus on what we do best - payments - and let you focus on your areas of expertise.

“As you go down the age range, wallet purchasing is increasingly important. Not supporting these wallets is another potential barrier to somebody who wants to buy. Whatever payment methods you want should be there in front of you. To do this, you need a big stack of payment methods to start with, which is why we chose Adyen.”

Still want to learn more?

Explore how we can help you integrate the latest digital wallets.

Get in touch