Smarter fraud decisions, made visible

See exactly how our machine learning models assess fraud risk. Get insights into the signals behind each decision so you can act with more confidence and control.

April 2025

Understand the why behind every fraud block

We’ve made it easier to see how fraud decisions are made. Now, when a payment is blocked or flagged, you can view the specific signals our machine learning models used to assess the risk, drawing from your own data, checkout inputs, and our global network.

Make more informed decisions

This transparency helps you evaluate the model’s logic and adjust your setup with custom rules when needed. Whether you're looking to refine your risk settings or provide clarity to operational teams, these insights are now at your fingertips.

Explore the signals

To access the signals, go to any card based payment that was fraud disputable (e.g. a Mastercard payment). You can do so via the Customer Area > Transactions > Payments > Select a payment and click on the Risk score.

To further drive the classification accuracy of Protect, please ensure that you are sending all required fields, where possible including Checkout information to drive the highest possible accuracy.

Latest updates

More payment methods move to Sales Day Payout

Walley, Riverty, PayPo, and Cash App now follow Sales Day Payout, giving you more predictable and easier-to-reconcile payouts.

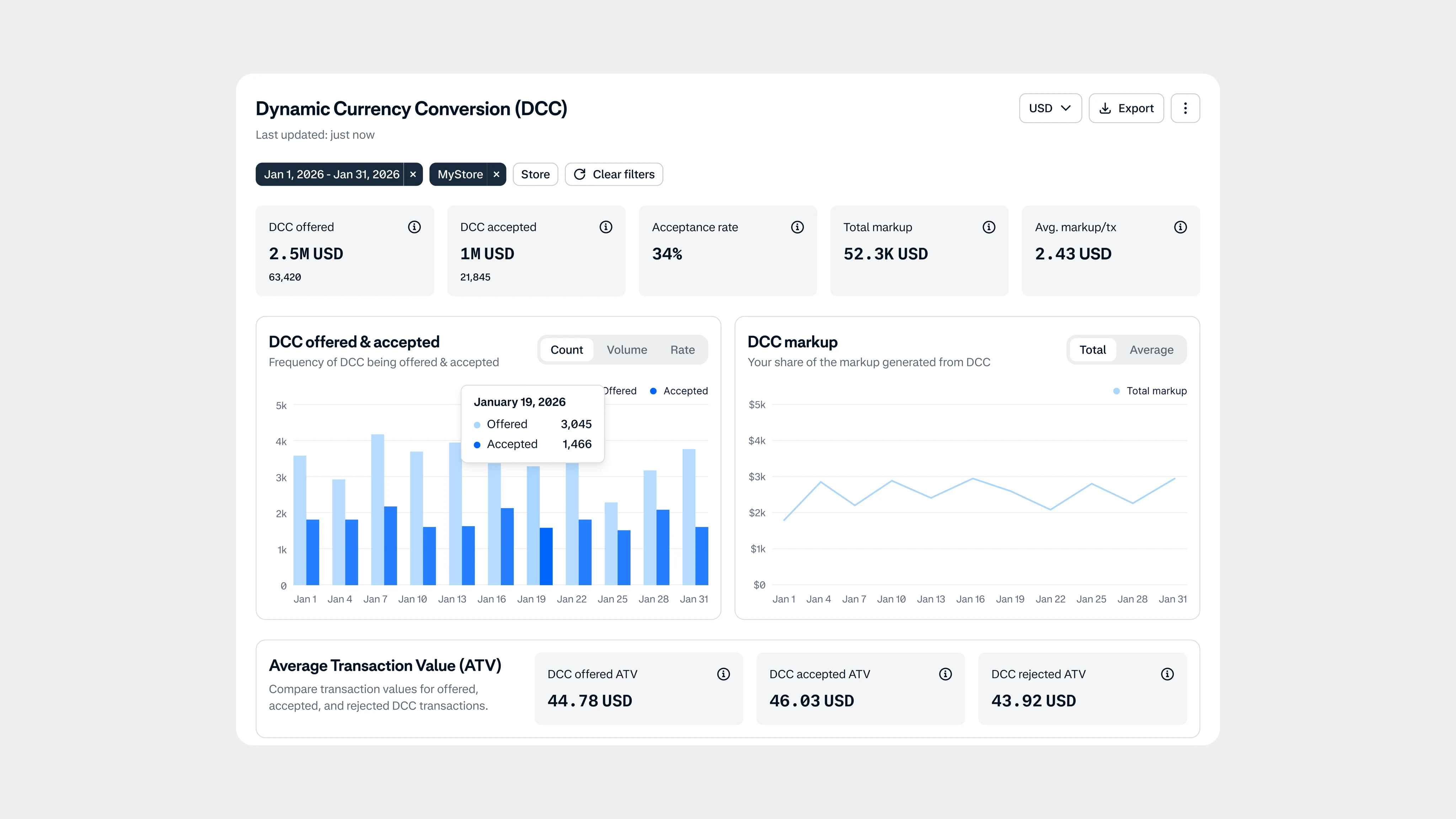

In-person payments

In-person paymentsBetter visibility into DCC margins and acceptance

Track DCC acceptance, revenue, directly in the Customer Area with the new Dynamic Currency Conversion dashboard.