Use insights to drive your business growth

Manage your payments and access real time data across all channels from your Adyen Customer Area.

Understand your customers

Get insights into channel performance and real time payment behavior.

Easy user management

Assign users to manage risk, perform refunds, add payment methods, and more.

Analyze across channels

Connect your online and offline payments for a true unified commerce view.

Make meaningful decisions

With all of your business data at your fingertips, finding out revenue generated by each channel and the number of payments made with each payment method will be a breeze.

Simplify your operations

Automate the management of your payment data while automating manual processes so you have more time to run your business.

Understand and predict your cash flow.

Manage chargebacks and risk.

Export or connect data to third-party systems.

Manage your payment terminals.

Action on your insights

Get to know the customer behind each payment with unified data from all of your sales channels and markets.

Understand channel performance.

Examine payment method effectiveness.

Uncover high-spending and frequent purchasers.

Test the impact of your loyalty programs.

Take full control

From overview to in depth: all you need to set your account up for success, and analyze and optimize every step of your payments flow.

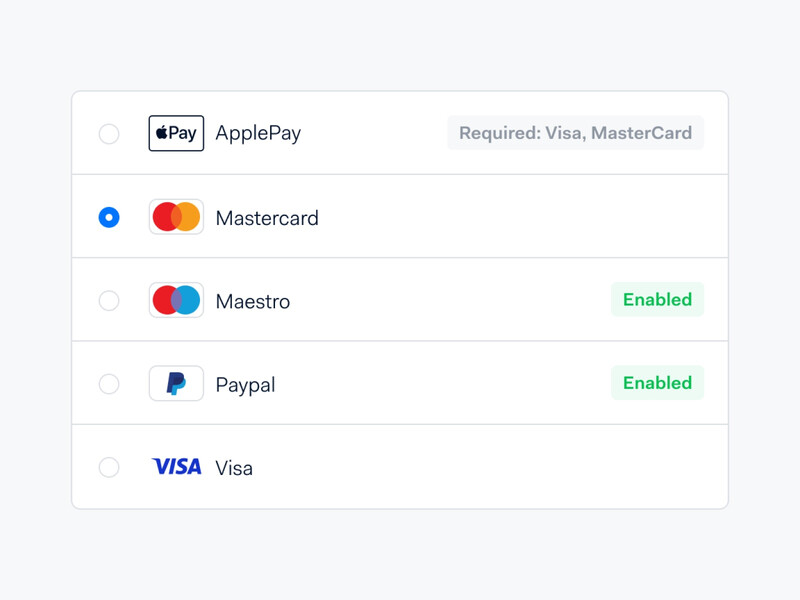

Add new payment methods

Effortlessly enable the payment methods your customers know and trust as you grow into new markets.

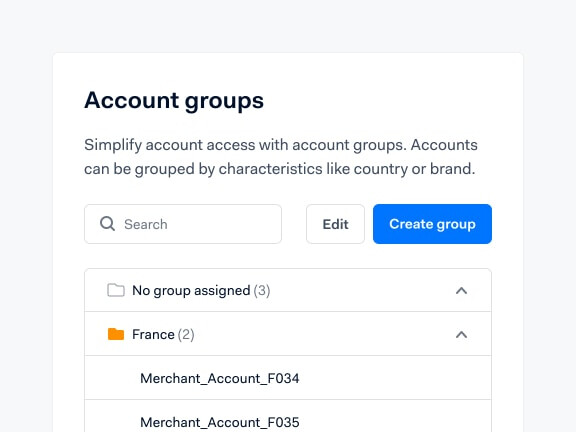

Create local accounts as you expand globally

An account set up that matches your business needs and structures.

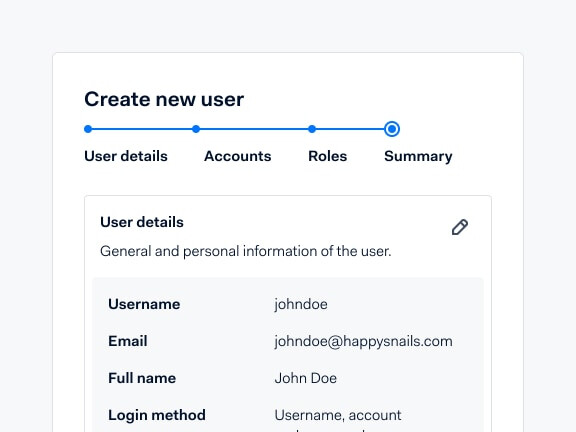

Create users with ease

Guided step-by-step user creation and access management in a crystal-clear interface.

Simplify access management with single sign-on

Improve identity protection. Log in to the Customer Area using SSO.

Centralize account protection

Seamlessly secure, and controlled user access.

Upgrade security

Better password policy enforcement and multi-factor authentication.

Improve user experience

Users only need one password to access multiple applications.

Dashboard Essentials for franchisees

Dashboard Essentials is a slimmed down version of the Customer Area. Its simplified interface has all the tools franchisees need to run their daily payments operations, from reviewing high-level reports to performing refunds.