Mastercard

As one of the largest card schemes in the world, Mastercard dominates the co-branded credit card market in Europe. It’s also a market leader in many countries including Austria, Brazil, Canada, Colombia, Benelux, Germany, Hungary, and Venezuela.

Payment pricing

+

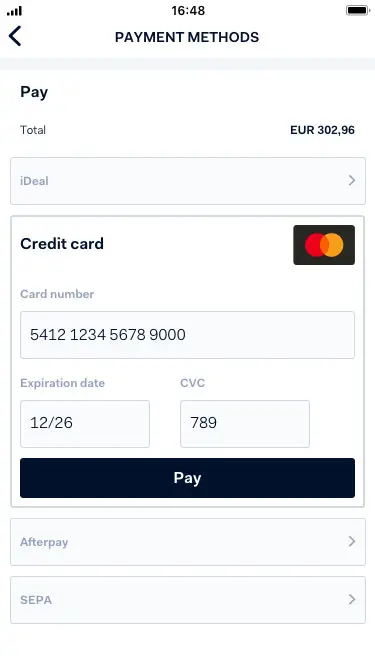

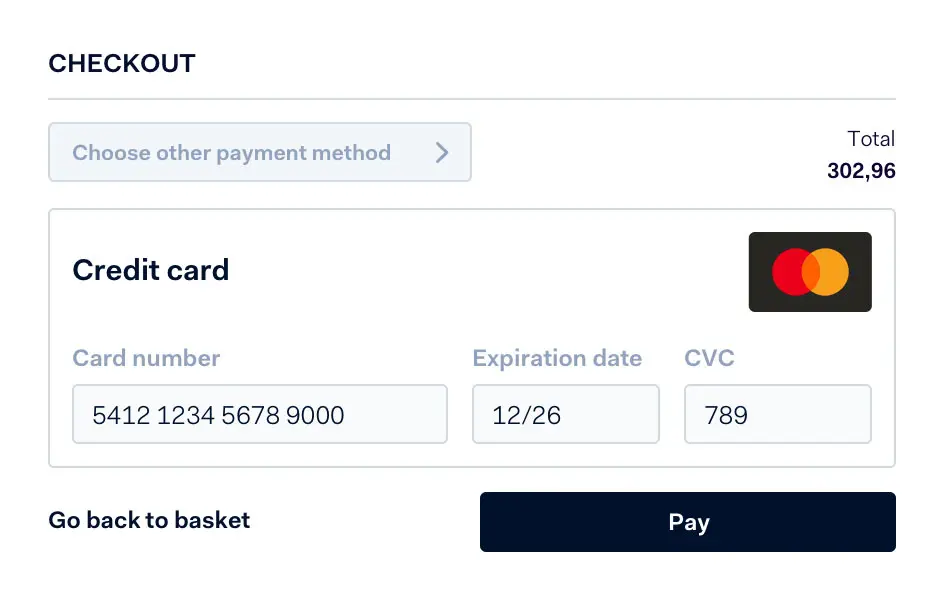

Support Mastercard debit and credit cards on a fully certified point of sale terminal, with Chip and Signature, Chip and PIN, or contactless authentication

Offer Mastercard Identity Check for additional security through 3D Secure

Support one-click payments when the shopper stores card details

Use Account Updater, to update card details after expiry

Subproducts

Maestro

Maestro is a brand of debit card issued by Mastercard.

Maestro cards can be used for in-store payments and for withdrawing cash at ATMs. It often requires on-line electronic authorization for every transaction, although Mastercard's rules permit the establishment of floor limits on Maestro EMV chip transactions only. Learn more about this product from here.

Mastercard has made the call to transition its Maestro brand of payment cards to Debit Mastercard; learn more from here.

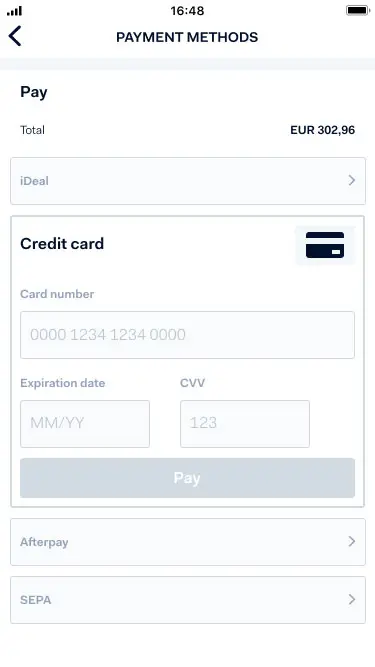

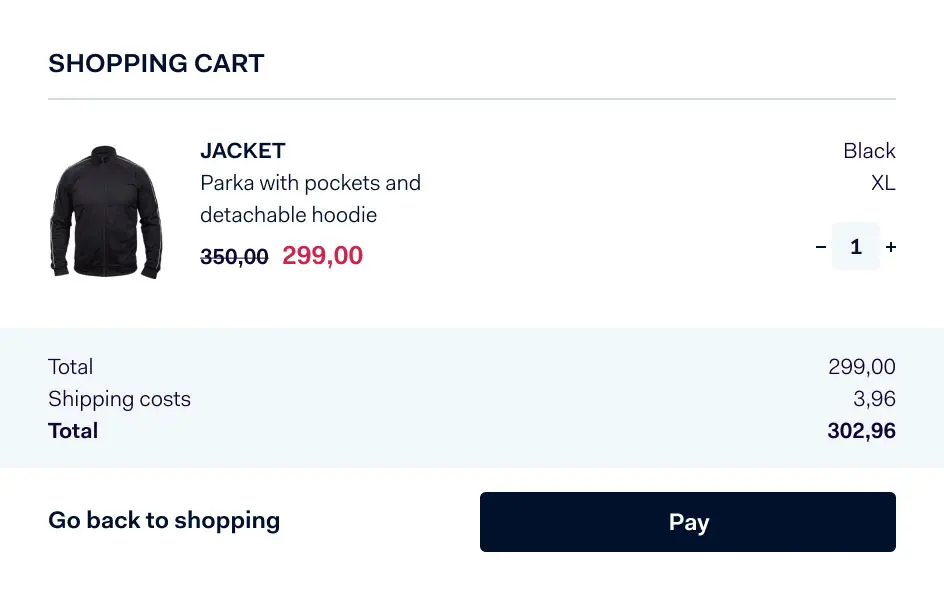

How it works

Features

Frequently Asked Questions

Want to see how people pay in other countries?

Browse and filter 100+ payment methods on region, channel, and more.