Guides and reports

Debit Mastercard is replacing Maestro: Here’s what you need to know

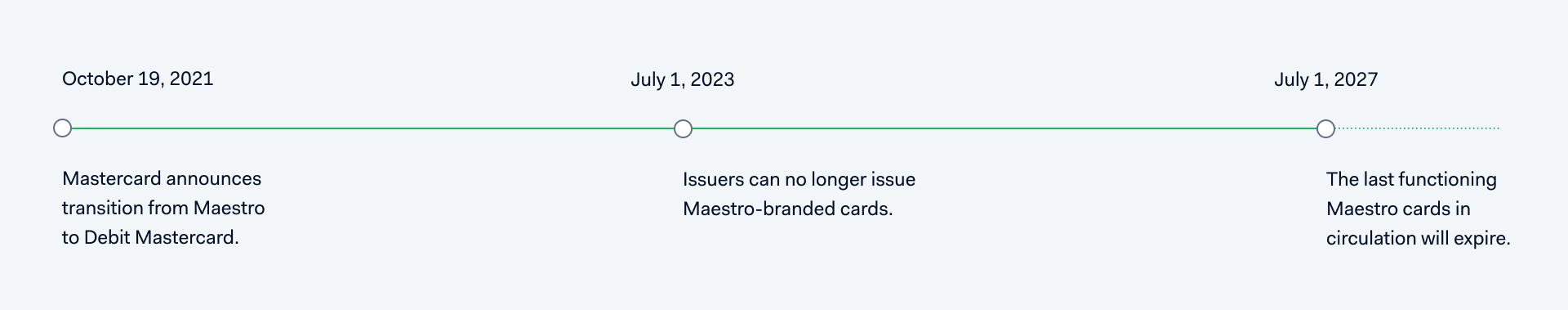

From July 2023, banks and other card issuers will no longer issue Maestro cards. Instead they will need to issue Debit Mastercards. Find out what this means for your business, what the timeline is, and how Adyen can help.

Mastercard has officially announced it will replace its Maestro debit card service with Mastercard-branded products after more than 30 years of Maestro circulation. The decision is a significant one, with a number of potential implications for retailers and their customers around the world.

So what does this change mean for you and your business? Here’s everything you need to know about the Maestro to Mastercard transition, how it affects you, and what the Adyen team is doing to help.

The Maestro to Mastercard Debit transition

Mastercard has made the call to transition its Maestro brand of payment cards to Debit Mastercard. This means all Maestro-branded cards will, over the next few years, be replaced with Mastercard-branded cards for all product categories: consumer debit, consumer prepaid, consumer credit, and business.

As of 1 July 2023:

- Mastercard will no longer issue Maestro-branded cards. New cards, renewals, and replacements of all Maestro-branded cards will be replaced by Mastercard products

- Banks and other card issuers will no longer issue Maestro cards. Instead they will need to issue Debit Mastercards

- Debit Mastercard will be the most common choice of replacement for Maestro, as they are accepted wherever Mastercard is accepted online and offline

- All acquirers are recommended to help ensure Mastercard product acceptance readiness by this date

New Maestro cards, renewals, and replacements issued before 1 July 2023 may remain in circulation and continue to work as usual until they reach their expiration date. This means that Maestro cards will still be functioning in the field until 2027 at the latest.

Why is Maestro being replaced by Mastercard?

Maestro is one of Mastercard's best-known brands of payment cards. It was launched in 1991, around the time the internet itself came into being. Maestro was the world’s first point of sale (POS) debit card that could be used anywhere in the world via an online network. About 400 million Maestro cards are in circulation worldwide as a mass debit product. It’s particularly common across Europe, with key markets in Germany, Italy, the Netherlands, Belgium, Switzerland, and Austria.

Despite its popularity, Maestro is a product of its time, when online shopping was not the norm. It was built primarily for traditional commerce, the in-person, brick-and-mortar, physical world kind. A large portion of Maestro cards are therefore simply not enabled for ecommerce and can’t consistently be used by cardholders for online and in-app payments.

Today’s consumers are accustomed to the convenience and personalisation of a digital-first world. The COVID-19 pandemic has only served to accelerate this. As Maestro can no longer provide cardholders with the capabilities they require, it makes sense to switch the product to one that can. The Mastercard network is twice as large as Maestro and offers far more possibilities for ecommerce transactions. As Valerie Nowak, EVP Product and Innovation at Mastercard Europe, states:

“As the world continues to rapidly transition from physical to digital, with consumer needs and behaviours changing accordingly, our goal is to provide people with a convenient and safe way to shop.”

How does this affect me as a merchant, and how can Adyen help?

If you're an Adyen merchant, you can relax. We can already accept all Debit Mastercards in-store, as well as online. We've also already tested this with Mastercard, so we're fully prepared for the transition. That means you can take the change in your stride: there is no action required.

Merchants with other providers may need to wait until their provider is ready to accept debit cards. Technological systems and payment terminals may have to be adapted. Mastercard is working hard with acquirers and merchants to close a possible acceptance gap, but this is of no concern for Adyen merchants, as we are already fully compliant.

Mastercard will soon begin successively transitioning Maestro-branded cards to the Mastercard brand and functionality in the European region. Belarus, Russia, and Switzerland are not included in the transition at this time. Issuers may also begin replacing expired or lost Maestro cards with Debit Mastercards from now on. No update on Mastercard pricing has been introduced for the time being.

How will customers benefit from the Maestro to Debit Mastercard transition?

Mastercard-branded card programs provide consumers with features not available on Maestro; features that cater to today's modern consumer needs and expectations. The transition will let customers take full advantage of the digital benefits and convenience of today’s payment ecosystem.

The transition from Maestro to the Mastercard brand will benefit customers by providing cardholders with:

- Access to a wider retail acceptance network worldwide: Mastercard is accepted in far more places than Maestro

- Expanded ecommerce abilities: cardholders can pay online with their debit card, set up recurring payments with their favorite apps and services, and much more

- Greater ease of everyday life thanks to the convenience of digital channels

- The ability to pay for services requiring a POS pre-authorisation, such as hotel bookings and car rentals

- Access to a broader range of Mastercard sponsorship assets

- Purchase protection and chargeback protection

Cardholders won’t need to do anything in light of the transition. If their Maestro card expires after 1 July 2023, their bank will send a new debit card that will be linked to their current account, and operate the same way as their old Maestro, but with greater capabilities.

We’re here to help

If you’re an Adyen merchant, you’re now fully up to date on the Maestro to Mastercard transition – and since we can already accept Debit Mastercard, you won’t need to do anything further. We’ve got this covered. If you have any questions, reach out to your usual Adyen contact for more information.

Not yet an Adyen merchant and want to start accepting all types of payment methods immediately? New Adyen merchants are enabled to accept both Maestro and Debit Mastercards from the start, so you still have time to give your customers the payments experience they expect.