H2 2020

Shareholder Letter

*Historical figures have been adjusted since prior publications of results.

Business resilience amid global pandemic

Substantial net revenue growth (70%) in North America

Strong growth in online retail due to accelerated digitization of global commerce

Surging ecommerce volumes alongside store reopenings

Strong performance across growth pillars

Well-diversified merchant base compensated for declining travel volumes in enterprise

Momentum in unified commerce due to acceleration of longer-term tailwinds

Growing the mid-market merchant portfolio

Merchant-driven innovation on the single platform

Building IdentityRisk — sub-seller fraud checks on Adyen for Platforms

Scaling Adyen Issuing — rolling out over 30,000 cards with a single merchant

Launched mobile Android POS devices

Scaling the Adyen team and culture

Growing the team to 1,747FTE — focus is on scaling the culture

The team’s wellbeing as a focal point during COVID-19

Global expansion - opening an office in the Middle East

Continued profitable growth and business resilience amid challenging year

February 10, 2021

The business has proven resilient in the second half of the year. Despite the continued impact of COVID-19 on the world economy, we experienced substantial growth as online retail and digital goods volumes surged while the decrease in travel volumes persisted. Amid the constantly shifting environment of the pandemic, we focused on best helping our merchants. We were able to help move volumes online swiftly when stores closed and facilitated safe operations in reopening scenarios, as all our point-of-sale (POS) devices enable contactless payments.

The business’ resilience over the period was fueled by the continued diversification of our merchant base across verticals and regions. Most notable is the pace at which North American net revenue contributions grew. With a 70% year-on-year increase, net revenue contributions from the region rose to 20% of total net revenue in H2 2020, compared to 15% in H2 2019.

Historically, we have mainly helped North American merchants process payments outside of their home markets, mainly due to the North American payments market's relatively static nature. In recent years, we saw complexity increase, especially in the domain of unified commerce. This allowed us to board domestic volumes that previously might have been out of reach. Illustrative is how we partnered with DICK’S Sporting Goods to process their in-store, in-app, and online volumes. These are volumes that would not have been a logical fit in prior years — we are now seeing that shift.

At the start of the period, total processed volume recovered to pre-pandemic levels and trended upward since. The uptick in online retail volume that followed physical store closures in the first half of the year was a trend that persisted in the second half — now alongside recovering in-store [1] volumes. In the travel vertical, volumes remained below pre-pandemic levels as macroeconomic conditions directly impacted this space. During the shopping holiday season, spanning across days such as Singles’ Day, Black Friday, and Cyber Monday, we recorded peak volumes on the platform. Platform reliability is highly important during the online retail season, as we build to help our merchants capitalize on the increased traffic this period brings.

POS volume for the second half was €21.3 billion, comprising 12% of total processed volume, compared to €18.2 billion and 13% in H2 2019. For the full year, POS volume was €32.2 billion and 11% of total processed volume, compared to €29.2 billion and 12% in 2019, respectively. We consider these growing POS volumes amid world-wide store closures as a testament to the strength of our offering in this space. In line with that growth, we saw the roll-out of POS projects return to usual speed during the second half of 2020, following earlier delays after initial lockdown restrictions in H1.

[1] In-store retail volume is not a proxy for total point-of-sale volume

Figure 1

Weekly total processed volume and weekly travel volumes indexed to the first week of January

Figure 2

Weekly retail processed volumes indexed to the first week of January

Full-stack volume [2] share for H2 2020 was 82%, up from 73% in H2 2019. For the full year this was 80%, up from 72% in 2019. This increase is mainly driven by the decline in airline volumes during the period — these are volumes for which we tend not to do acquiring.

Amid the ever-changing environment of the pandemic, we also saw several longer-term trends persist. Some were even accelerated due to COVID-19 — including the shift from cash to cashless economies and the digitization of global commerce. Several longer-term trends on the platform persisted too — with overall merchant concentration further declining, volume churn remaining below 1%, and existing merchants continuing to make up over 80% of our growth.

We continue to build Adyen for the long term — with a singular focus on helping our merchants grow. As such, retaining the flexibility to invest in our global presence, the team, and the platform remains essential to us. Following this philosophy, and in anticipation of further growth, we opened an office in Dubai and expanded our acquiring footprint to include Puerto Rico. We also continued to build the team across regions — growing the Adyen team to 1,747 FTE.

[2] Full-stack volume is volume for which we are part of the money flow, and therefore are paying out to our merchants

Solid volume contributions across merchant base

Enterprise merchants in online verticals continued to be our main growth driver. We work hand-in-hand with these merchants across regions and product lines to ensure their growth is never held back by their payments set-up. We continued to see increasing diversification across our enterprise merchant base, which helped us during a year where COVID-19 impacted everyone. We see this as a proof point of the business’ resilience going forward.

We also continued to roll out Adyen for Platforms during the second half of the year. Adyen for Platforms allows us to provide the long tail of the market with access to the full power of the Adyen platform through enterprise-level partnerships. By partnering with merchants like Modernizing Medicine, a business technology provider to over 150,000 medical practitioners, we deliver SMEs the payment technology required to successfully operate their businesses. To further enhance our offering for platform merchants, we continue to build for its scalability — most notably with automated information and verification checks and extensive sub-seller fraud controls implemented over the full year.

In the unified commerce space, the convergence of the offline and online channels continued to be a major theme — shoppers expect a single brand experience, regardless whether they are buying online or offline. During the period, we saw the historical trend of merchants adding a second channel on our platform speed up. Illustrative to this development, and the land-and-expand approach with existing merchants that we have employed since foundation, is how we have grown our partnership with H&M. In 2018, we started a global partnership across key markets in Europe and North America, focusing on online volumes. Today, we are proud to announce that we are rolling out our full unified commerce offering across Europe, the US, Canada and Puerto Rico with them.

Within the retail vertical, we started at the high end of the market where there was more complexity to solve for — e.g. creating personalized shopper journeys. In recent years, we have successfully moved into retail more broadly, as shoppers across the spectrum are increasingly expecting seamless experiences across channels. We continued to add household names to the platform from all ends of the retail segment — including Boulanger, Ralph Lauren, and Gianvito Rossi.

As the COVID-19 pandemic continued, the day-to-day of many merchants in the in-store retail and quick-service restaurant verticals were impacted by the closure of physical outlets. We saw that unified commerce merchants could more easily adapt to the current environment — as offering in-app and online ordering, as well as curbside pick-ups were essential to keeping sales up. Our unified commerce offering has proven to be especially well-suited for facilitating these experiences, and made renowned players like Hungry Jack’s opt for the solution. In post-pandemic reopening scenarios, we view the need for contactless payment set-ups as an opportunity to showcase the strength of our unified commerce offering.

We experienced initial traction in the hospitality vertical in the second half of the year — with merchant wins ranging from high-end boutique resort QC Terme to international hotel group Yotel. The fact that hotel and resort guests increasingly expect state-of-the-art experiences with seamless booking, check-in, and check-out across channels helps us — offering multi-channel experiences has always been our strength in retail, and now helps us move into new verticals.

In the mid-market segment, we are increasingly moving toward an approach that encompasses all down-market segments from enterprise. We go to market with a direct sales approach in the higher end of mid-market, while enabling marketing-driven strategies and engagement via partnerships and system integrator communities to reach down the long tail of the market. To service businesses of all sizes, our lower-touch approach through partnership models provides us comfort on scalability, without compromising on organizational efficiency or culture.

Merchant-driven innovation on the single platform

Product innovation on the single platform continued to be a co-creative process with our merchants, despite the pandemic. The workstreams that make up the Adyen product organization work directly with our merchants, ergo can efficiently prioritize their needs. To ensure that we address our merchants’ needs at speed, company-wide strategy is set annually based on these workstreams’ goals.

This merchant-centered approach to product development is clearly reflected in how we built the Network Token Optimization feature of our RevenueAccelerate product in partnership with Microsoft. Through EMVCo-certified cloud tokens, the feature enables a more secure way of obtaining payment approval — without having to send or store sensitive data such as PANs (primary account numbers). By deciding whether to seek approval via a token or a PAN via smart transaction routing, the feature facilitates higher authorization rates for our merchants.

Another example of our merchant-driven innovation is IdentityRisk, a support tool that enables sub-seller fraud checks at scale for platform merchants. We were already helping our merchants identify shopper fraud with our RevenueProtect product, and now offer this functionality on the sub-seller level as well. Improving effectiveness and reducing time spent on sub-seller fraud checks, the feature increases operational scalability for merchants running platforms.

Adyen Issuing was implemented at scale in the second half of the year, as we are now rolling out 30,000 cards with Glovo — an on-demand courier service. The extensive use of the product by Glovo couriers allows us to iterate based on real-world use cases. This is an exciting avenue for growth — and we are just at the beginning here.

On point-of-sale hardware, we launched Android-based mobile POS devices during the second half. These devices integrate the hardware and software that historically would complicate in-store operations (e.g. inventory management software, customer loyalty programs, staff communication tools) in one device. Due to its all-in-one function, these smartphone-sized, portable terminals significantly enhance in-store efficiency. We see potential use cases range from merchants avoiding in-store queuing, to streamlining in-store operations or facilitating curbside pick-ups.

The trend towards stronger authentication across the payments landscape continued in 2020. The PSD2 (Payments Services Directive 2) regulation is now gradually being enforced in Europe, and we are ready to help our merchants adapt by using our 3DS2 tool. The feature, which we were first-to-market with, is built to facilitate uplifts in conversion and authorization rates in this new environment. We expect that the regulation will bring conversion rates down across the industry, but there are efficiency gains to be made in solving for this reality most elegantly.

Lastly on product, we are proud to mention our donation tool Adyen Giving. Adyen Giving facilitates direct donations to our merchants’ preferred charities in the checkout process via a two-transaction logic. This natural extension of the payment flow enables fundraising at scale and simplifies the charitable donation process for our merchants, their shoppers, and good causes. To ensure the full donation amount goes to its beneficiary, we take on the cost of the donation transaction if the beneficiary supports at least one of the United Nations’ Sustainable Development Goals.

Scaling the Adyen team — for now from a distance

We are building Adyen for the long term, and therefore continuously invest in offering our merchants the best technology and support. This approach is reflected in how we are building the team, with 43% of new hires in commercial roles and 42% of hires in tech. Paving the way for long-term growth, we added 299 FTE in the second half of the year. The Adyen team now totals 1,747 FTE.

With the amount of hires made during the year, largely in a work-from-home setting, ensuring that we did not compromise on culture was at the center of attention. Senior management continued to dedicate significant time to the hiring process and virtually met every new hire before joining the team. Additionally, we launched board-led training sessions for new and existing team leads and continued our online onboarding and training programs. Considering that new joiners have not been able to work from our offices, we took an additional level of scrutiny and regularly assessed our absorption rate.

To best help our merchants, we need a team that includes different perspectives and realize that inclusion should be designed for. This is something that is also represented in the Adyen Formula. To ensure that we go about building equitable teams, we thoroughly reviewed and redesigned our recruitment and interviewing processes in the second half of the year.

As we reflect on a challenging year, wherein the wellbeing of the team was a focal point, we realize that the shift towards an online environment also brought valuable lessons. Perhaps paradoxically, the team felt more global than ever. Videoconferencing turned out to be a great equalizer across time zones, with location increasingly irrelevant, as the number of cross-continent meetings and global team events steeply increased during the pandemic. We are incredibly proud of the flexibility of the team. These are lessons here that will be vital to Adyen going forward, no matter how the upcoming years develop.

Figure 3

Adyen’s 2020 FTE growth

Discussion of financial results

Robust volume growth from existing merchants

We processed €174.5 billion in the period, up 29% year-on-year. For the full year, processed volume was €303.6 billion, up 27% year-on-year.

POS processed volume was €21.3 billion in the second half of the year, making up 12% of processed volume. For the full year, this was €32.2 billion and 11% of total volume. Lockdown restrictions strongly impacted in-store volume throughout the year.

Solid net revenue growth due to continued diversification across regions

Net revenue was €379.4 million [3] in the second half of the year [4], up 28% year-on-year. For the full year net revenue was up was 28% as well, totaling €684.2 million.

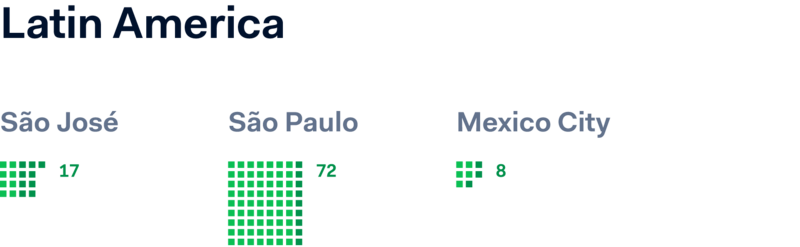

On net revenue growth, North America (70%) outpaced APAC (30%), Europe (22%), and LATAM (6%). The delta in growth rates is mainly driven by the impact of COVID-19 on our merchant mix.

Net revenue contributions continued to diversify across regions in the second half of the year, with Europe remaining the largest contributor to net revenue at 62%, followed by North America (20%), APAC (9%), and LATAM (8%).

Take rate was 21.7 bps in H2 2020, down from 22.0 bps in H2 2019. For the full year, take rate was 22.5 bps, up from 22.3 bps in 2019. Take rate continues to not be a driver for us, as the low cost of operating the Adyen platform allows for focusing on incremental net revenue.

Investing in a global Adyen for the long term

Total operating expenses were €157.7 million in the second half of the year, up 18% year-on-year, and representing 42% of net revenue. For the full year, operating expenses were €310.3 million, up 29% year-on-year, and representing 45% of net revenue. This increase is mainly driven by employee benefits.

Employee benefits were €92.4 million in H2 2020, up 37% from €67.6 million H2 2019. For the full year, employee benefits were €180.0 million, up 47% from €122.4 million for full year 2019.

Other operating expenses were €50.3 million in the second half of 2020, down 8% from €54.7 million in the second half of 2019. This drop is mainly due to the decrease in travel expenses following global travel restrictions caused by the COVID-19 pandemic.

Sales and marketing expenses totaled €18.2 million for the period, down 3% from €18.7 million in H2 2019, as our focus shifted from physical events in enterprise to running online marketing campaigns.

FY 2020 other operating expenses were €101.9 million, up 7% from €95.1 million for FY 2019 operating expenses. Of these, sales and marketing expenses were €39.6 million, up 23% from €32.3 million for FY 2019.

EBITDA reflecting sustained profitability amid investments in long-term growth

EBITDA for H2 2020 was €236.8 million, up 36% year-on-year from €174.5 million in H2 2019. For FY 2020, EBITDA was €402.5 million, up 27% year-on-year from €316.9 million in 2019.EBITDA margin was 62% in the period, and 59% for the full year.

Net income

Net income for the second half of 2020 was €163.1 million, up 27% from €128.4 million in the second half of 2019. For the full year, net income was €261.0 million, up 11% from €234.3 million in 2019.Full year net income was impacted by the movement in other financial results, largely caused by the increase in value of the derivative liabilities as a result of the increase in the Adyen share price.

Solid free cash flow conversion

Free cash flow conversion was €217.0 million in the second half of 2020, up 37% from €158.1 million in the second half of 2019. For the full year, free cash flow conversion was €371.1 million, up 29% from €287.1 million in 2019.Free cash flow conversion ratio5 was 92% in the second half of 2020, up from 91% in H2 2019. Free cash flow conversion ratio was 92% for FY 2020, up from 91% in FY 2019.

CapEx remains stable as investments in scalability continues

In the second half of 2020 CapEx were 4% of net revenues, slightly up 4% year-on-year from H2 2019. For the full year, CapEx were 3% of net revenue, 14% down from full year 2019.

[3] Historical figures have been adjusted since prior publications of results. Please refer to note 1 of the financial statements on page 31 and 32 for a full reflection of adjusted numbers.

[4] On a constant currency basis, H2 2020 gross revenue of 2,081 million would have been 6% higher than reported. Net revenue of €379.4 million would have been 9% higher than reported. Please refer to Note 1 of the Interim Condensed Consolidated Financial statements for further detail on revenue breakdown.

Adyen shareholder letter H2 2021

Figure 5

H2 2020 Consolidated statement of comprehensive income. All amounts in EUR thousands unless otherwise stated

We have set the following financial objectives, wherein EBITDA margin guidance has been updated since prior publications. Other objectives remain unchanged since IPO.

Net revenue growth: We aim to continue to grow net revenue and achieve a CAGR between the mid-twenties and low-thirties in the medium term by executing our sales strategy.

EBITDA margin: We aim to improve EBITDA margin, and expect this margin to benefit from our operational leverage going forward and increase to levels above 65% in the long term.

Capital expenditure: We aim to maintain a sustainable capital expenditure level of up to 5% of our net revenue.

On EBITDA margin — given the substantial growth and operating leverage we have seen since IPO, combined with our continued focus on the scalability of our single platform, we expect this upward trend to continue to levels of over 65% in the long term. We are still at an early stage of building Adyen, and view the short-term flexibility to invest in longer-term opportunities key to reaching this objective.

We will host our earnings call at 3pm CET (9am ET) today (February 10) to discuss these results.

To watch a live video webcast, please visit our Investor Relations page. A recording will be available on the website following the call.

As an appendix to this letter, please find attached three one-page updates on our growth pillars (Enterprise, Unified Commerce and Mid-Market) and our H2 2020 financial statements.

Sincerely,

Pieter van der Does

CEO

Ingo Uytdehaage

CFO

Enterprise

The enterprise space continued to drive the majority of our growth. Our continued success in this space stems from our ability to solve for our merchants’ payment complexities and how we build trusted partnerships with them. We consistently grow with them as they expand to new regions, sales channels, and product lines.

Enterprise volume in EUR billions

Unified Commmerce

The pandemic further accelerated the trend of merchants opting for a unified commerce approach. We saw that unified commerce merchants were more resilient when dealing with the challenges of the pandemic due to the flexibility of quickly shifting volumes between sales channels.

POS volume evolution, including share of total processed volume in EUR billions

Mid-market

We remain focused on building out our mid-market offering, and supporting these merchants in growing their business while solving for their payment complexities that arise along the way. In line with previous periods, we saw numerous mid-market merchants organically graduate into the enterprise segment.

Mid-market volume in EUR billions. We define mid-market merchants as merchants processing up to €25 million annually on our platform. In H2 2020, 4,278 merchants met this definition.

Interim Condensed Consolidated Financial Statements H2 2020 Adyen N.V.

H2 2020 Adyen N.V

Unsponsored ADRs: As of October 10, 2008, the US Securities and Exchange Commission (SEC) published revisions to Exchange Act Rule 12g3-2(b) which permits depository institutions to establish unsponsored ADR programs without the participation of a non-US issuer. Adyen NV does not consent to the establishment of any unsponsored ADR program, and further does not authorize, endorse, support or encourage the creation of any such unsponsored ADR program in respect of its securities. Adyen NV will not actively, directly or indirectly participate in the creation of any unsponsored ADR program. Adyen NV specifically disclaims any liability whatsoever arising out of or in connection with any unsponsored ADR program. Adyen NV does not represent to any depository institution or any other person, nor should any depository institution or any person rely on a belief that the website of Adyen NV includes all published information in English or that Adyen NV otherwise satisfies the exemption criteria set forth in Exchange Act Rule 12g3-2(b)